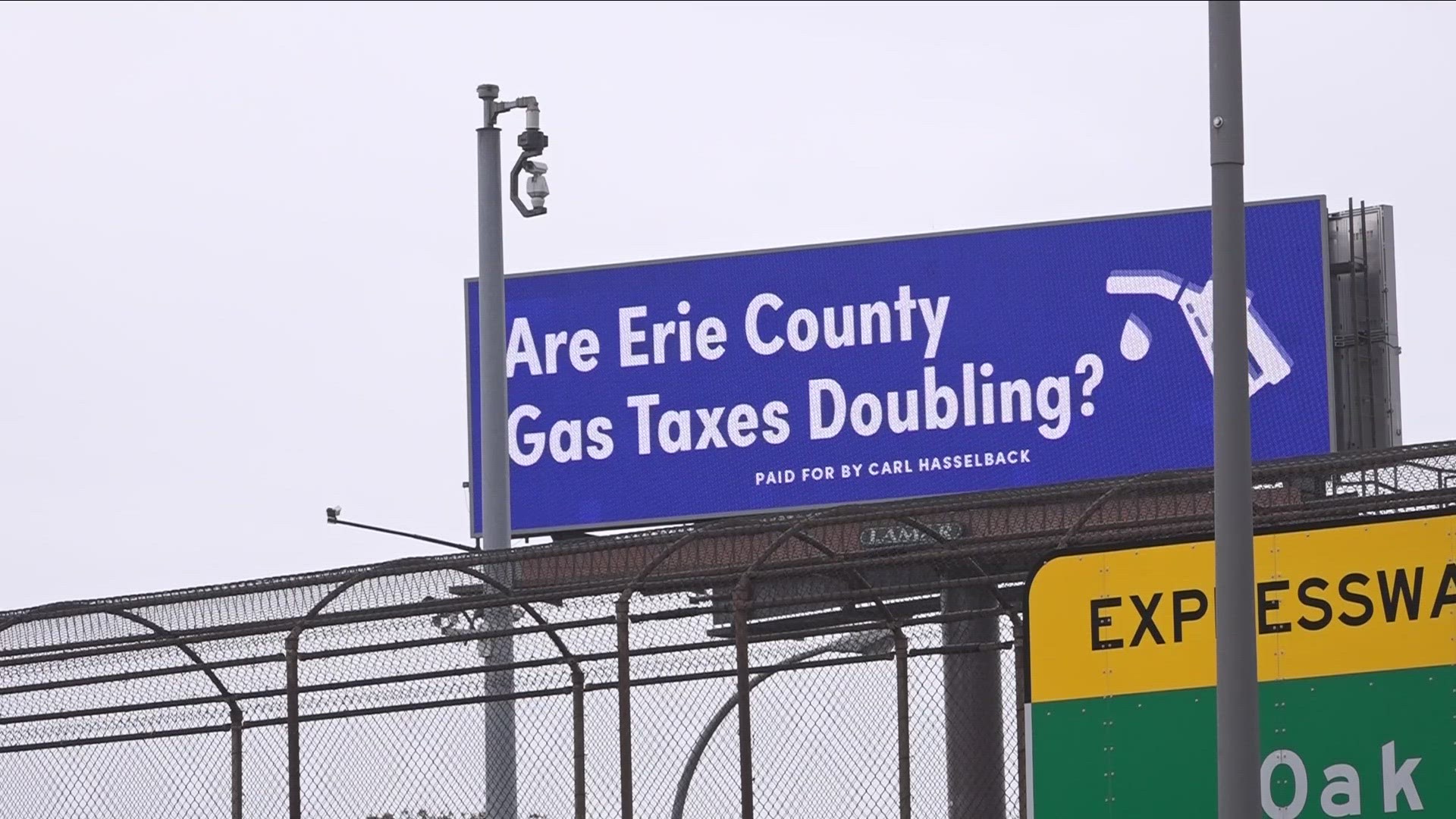

CHEEKTOWAGA, N.Y. — Indigo billboards with white text have popped up along several Western New York highways in recent weeks.

They all ask the same question: Are Erie County gas taxes doubling?

Curious drivers may have some questions of their own when passing by, like what gas tax? Or when?

The billboards give no explanation so 2 On Your Side got in touch with the man who paid for them, Carl Hasselback.

"The billboards there are six of them out there, there are two on the 190 there are two on the 33, there's two on the 290," said Hasselback, who owns a wholesale fuel company and several gas stations around the state.

The "gas taxes" referred to on the billboard are really only one tax, the county sales tax collected on gasoline which technically will be doubling at the end of the year but it requires some explanation.

Back in June, Erie County elected officials capped the 4.75% sales tax amount charged at the pump. It meant drivers then and now would only pay tax on gasoline as if it cost 2 dollars a gallon. Any price above that wouldn't matter.

The tax equals 0.095 cents/gallon or for simplicity's sake 10 cents a gallon so drivers, Monday paying $3.69 for regular at Jim's Trucking Plaza in Cheektowaga were saving about one dollar when filling up a 12-gallon tank.

At the end of the year, that 2-dollar cap will expire however and the sales tax collected by the county on gasoline will double or rather return to normal.

Hasselback put up the billboards in hopes of convincing Erie County lawmakers to extend the cap or better yet, change how sales tax on gasoline is collected.

"I want to see the tax become a flat tax like every other gasoline tax that's what it should be, at least it will equally impact everyone," Hasselback said.

The cap was originally proposed by County Executive Mark Poloncarz and passed by the Erie County Legislature to save people money.

"What I'm saying is if the 10 cents goes right up until after the election and then the 10 cents goes away...well I look at that and say did you really want to give me a break or did you just want to give me a break until after the election and then it's back to same old same old," said Hasselback.

The cap hasn't come without some compromises for the county, however. Erie County Comptroller Kevin Hardwick told 2 On Your Side back in February it would cost the county approx. 8 million dollars in lost revenue from June to December.

While Hasselback understands any change to the sales tax collected on gasoline would require the county to cut items from their already approved 2024 budget, he said that's kind of the point.

Hasselback adds to his argument in a series of television ads, that given the county's strong financial position, the already implemented cap could be an entry point for county lawmakers to slim the budget and pass along those savings to taxpayers.

Only so far Hasselback said he's gotten little response from lawmakers.