BUFFALO, N.Y. — The U.S. stock market rallied to a record high Wednesday after Donald Trump was elected to a second presidential term.

The Dow Jones Industrial Average ended the day up 3.6%, the S&P 500 rallied 2.5% and the Nasdaq jumped 3% all topping previous records set in recent weeks.

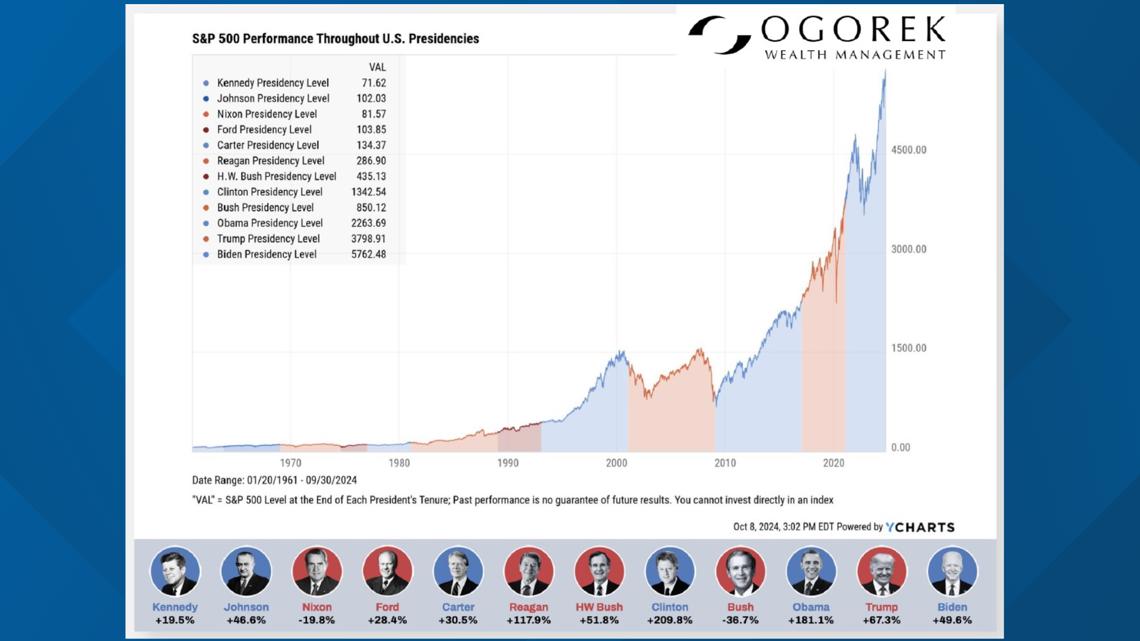

The boost is part of a historical trend, according to Tony Ogorek of Ogorek Wealth Management, where regardless of which party wins the Presidential race, the immediate impact is gains.

"Markets abhor uncertainty, and there was a lot of uncertainty about who was going to get elected and what the policy changes were going to be like," he said.

When the race was called for now President-elect Trump, that uncertainty was removed and what followed was a "relief rally." Ogorek explained that in most cases these types of rallies are temporary, although historically people have used them to project economic strength.

Fueling the rally are gains by the so-called "Magnificent 7" stocks, including Apple, Google, and Tesla, which represent about one-third of the S&P 500's value. Each company stands to benefit from a Trump presidency and the potential for relaxed regulation.

"For Buffalo Bills fans, it's very easy to understand this because it's analogous to what goes on with the kicker. When a kicker does not do well, they're blamed for losing the game. When the kicker does well, well, they get some credit, perhaps more credit than they should get for winning the game because it's a team sport," Ogorek said.

He added that in the long term, the President doesn't wield as much power over the economy as most people think.

"People like to take credit for things whether they deserve it or not and when you think about it it's kind of crazy that you take a four-year period of time which is arbitrary compared to hundreds of millions of people all over the world making individual decisions each day about where they want to invest and where they put their money," said Ogorek.

Feelings about how a President's policies may impact the economy long term are better reflected in the bond market he explained.

U.S. bond yields surged alongside the stock market Wednesday, indicating that inflationary concerns have increased with Trump entering the Oval Office.

Ogorek added: "What the market is saying is when you look at the overhang of debt we've got trillions of dollars in refinancing that's going to go on in the next 12 months plus some of the policies that are being proposed they really are inflationary and the market is concerned about that... so even though the fed is in a loosening cycle we still see the long run interest rate curve yields going up."

President-elect Trump has discussed tariffs of 10% to 20% on foreign goods which also have an inflationary impact on the economy.