BUFFALO, N.Y. — For the third time in the past year and a half, one of the nation's major credit rating agencies has downgraded the City of Buffalo's bond rating.

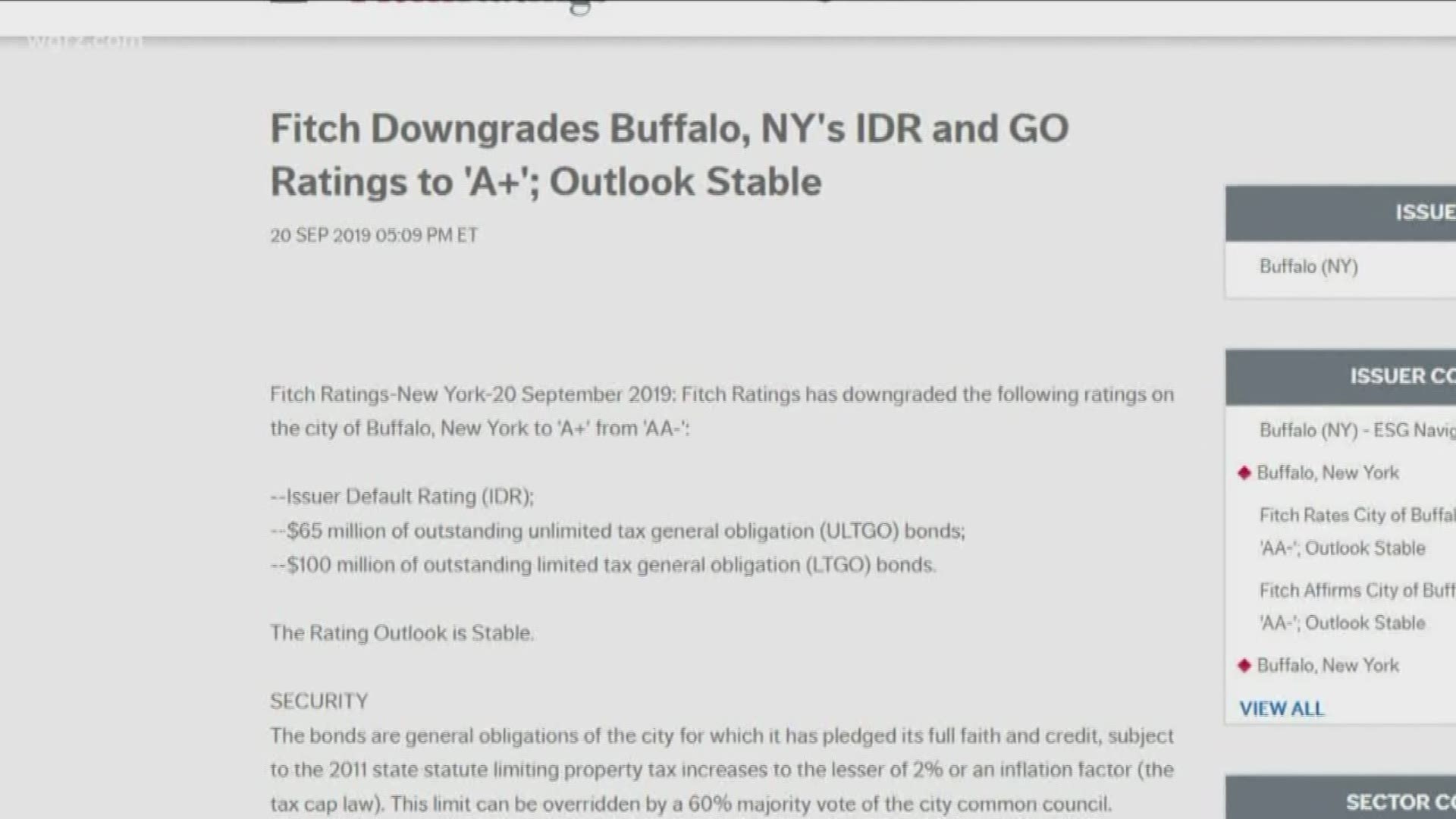

It's a minor down-grade by Fitch Ratings, yet its report raises some questions about the city's fiscal shape going forward…and some of the same questions which 2 On Your Side has been raising as well.

Mayor "Displeased"

“I have been managing the city with my management team very well for 14 years,” said Buffalo Mayor Byron Brown, when asked by WGRZ if the contents of the report and the downgrading of the city’s credit rating from “AAA-“ to “A+” is making him re-think the city’s fiscal policies and budget practices.

Indeed, the report says the city’s fiscal outlook is “stable”, and makes note that it is in far better shape than when Brown first took office in 2006, when the city’s finances were in such dire straits that a fiscal control board was appointed to oversee its spending.

However, the Fitch report does note areas of concern which we at 2 On Your Side and our non-profit news partners at Investigative Post have been raising for more than two years.

Specifically, that the Brown administration has pretty much drained a reserve fund which once totaled more than $100 million dollars.

Brown has maintained that using reserves to keep the city’s tax rate flat during most years of his administration was the wise thing to do, and continued to express that belief during an interview with Channel 2 News on Monday.

“We did that to make the city more attractive to residential and commercial investment and to return taxpayer money to the taxpayers,” Brown said.

Fitch also makes note of his administration's penchant for over-projecting revenues (something else we've reported on) to the point where the city spends more than it takes in, creating structural deficits in the past several years, and goes on to say that it expects “the natural pace of expenditure growth to outpace revenues absent policy action.”

This is an indication that unless some of the concerns the report raises are mitigated, the city’s credit rating could slip again in the future, especially if there is a downturn in the economy and it doesn’t have the reserves it might need to comfortably weather any resulting economic storm.

“I have had the opportunity with Fitch, at the highest levels, to indicate our displeasure and disagreement with their adjustment of the city's bond rating,” said Brown. “They said they would re-evaluate at a certain point."

State Will Advance the City some Casino Money

As the report notes, one revenue source the city has included in its budget is from its share of slot machine revenue at the Buffalo Creek Casino operated by the Seneca Nation of Indians under a compact with the State of New York.

This is despite the fact that for more than two years, the city has not collected a dime in such revenues, as casino payments have been held up due to a dispute between the state and the Seneca nation.

But on that front there is news, as Brown confirmed that the state, last Friday, agreed to advance the city $7.5 million against anticipated future payments once the dispute is ironed out. The state made the commitment the same day as the Fitch Report was released.

More Revenue from Re-Val?

“Ultimately, we think that more revenue will be produced for the City of Buffalo," said Brown, noting the city anticipates fattening its coffers through an increase in parking rates and the installation of school zone cameras aimed at catching speeders near schools.

At the same time, the city is now conducting is first city wide property reassessment in about 20 years.

“The reassessment has already shown that property values in the city of Buffalo have more than doubled from a little more than $6 billion to a little more than $12 billion," Brown said.

If those numbers hold, it could create a scenario whereby the city could actually keep the tax rate flat-- or even reduce it going forward, while still taking in millions of dollars more in property taxes.

Brown told us that after further review, he wouldn't be surprised if Fitch puts the credit rating back where it was.

“You could see that in a couple of months, or you could see that in a (fiscal) quarter,” Brown said.

Impact of the Fitch Report

While a municipality’s bond rating can, and does affect the amount of interest a city has to pay whenever goes to borrow, Brown does not think it will affect Buffalo’s going forward, because the downgrade in its bond rating was “minimal”.

“It will not affect our interest rates because it is a minor adjustment…we feel that we have made a number of policy changes, identified a number of new revenues, and that our plan is working and that we are moving in the right direction,” Brown said.