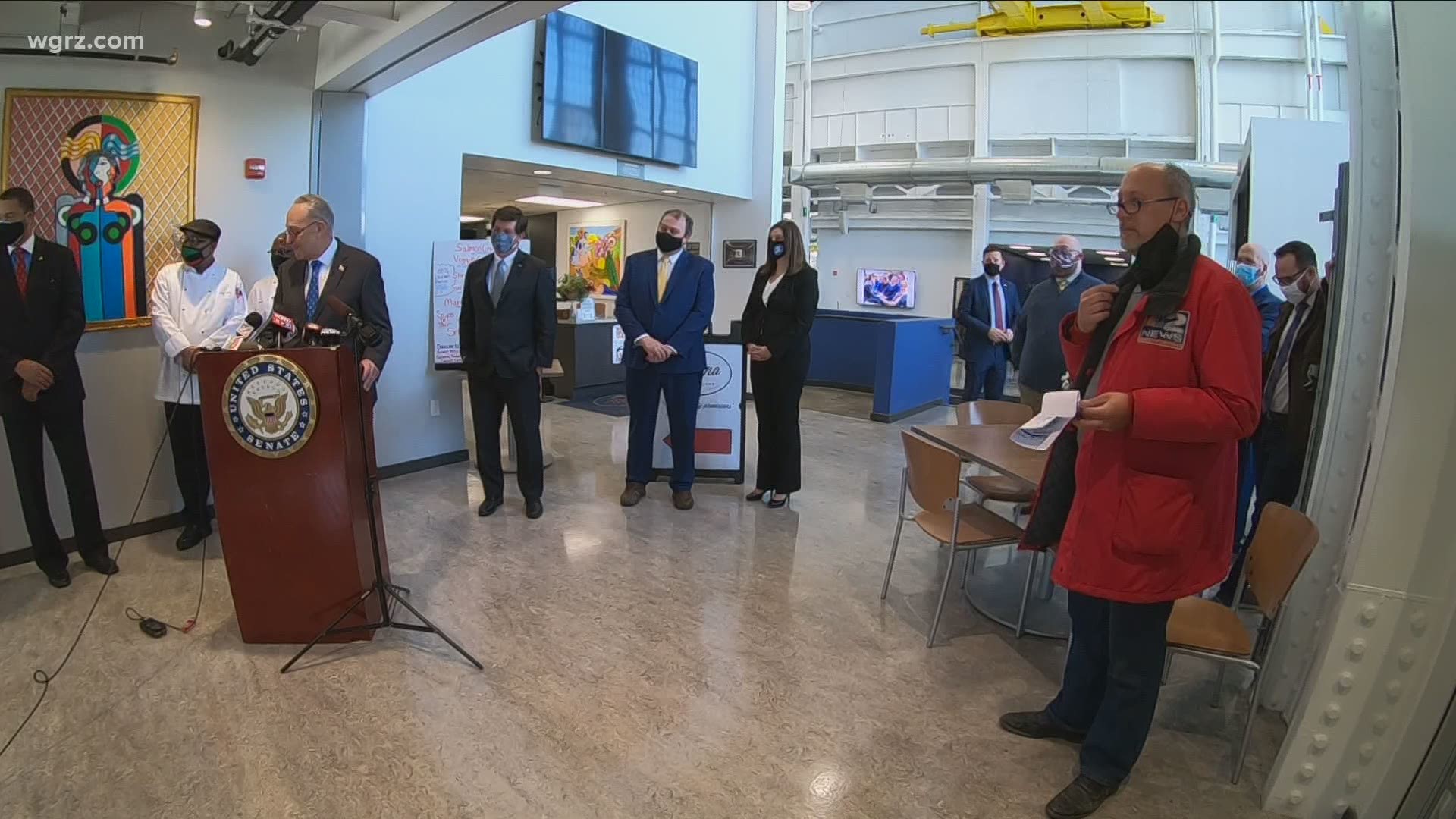

BUFFALO, N.Y. — Flanked by local government leaders, NY Senator Chuck Schumer (D) was in Buffalo Tuesday to discuss WNY specifics for the COVID-19 American Rescue Plan just passed in the Senate.

The Senate Majority leader appeared at Manna at Northland to provide details on the $100 billion dollar relief bill, including its impact on the restaurant industry which has been among the hardest hit by the pandemic.

“With 27% of New York’s restaurants saying they will not survive the next 3 months, Western New York restaurants, their employees and the overall regional economy still need immediate federal relief to weather COVID because too many of the places we know and love could close without the help, leaving a giant hole in our local economy,” said Senator Schumer.

“That is why I made sure this relief bill included a vital ingredient – a restaurants relief fund based on the RESTAURANTS Act– to get our restaurants ‘cooking’ again. Getting federal dollars into the hands of struggling small businesses, like restaurants in Western New York, not only makes sense, but it’s the recipe needed to keep small businesses like Manna at Northland going and keeping their workers on the job.”

New York restaurants are now eligible for their own, direct federal pandemic relief. The Restaurants Act will provide a down payment of $28.6 billion in flexible grants through the Small Business Administration (SBA). Food service food service or drinking establishments, including caterers, brewpubs, taprooms, and tasting rooms, that are not part of an affiliated group with more than 20 locations will be eligible. Grants from the fund can be used alongside first and second Paycheck Protection Program (PPE) loans and other economic assistance such as SBA Economic Injury Disaster Loan assistance, and the Employee Retention Tax Credit.

The grant money can be used to cover payroll, mortgages or rent, setup for outdoor seating, PPE, paid leave, food and other supplies, or debt and other expenses

Schumer also detailed how the American Rescue Plan will cut child poverty in half; critically important for WNY which has the second highest poverty rate in the nation. The plan:

- Makes the CTC fully refundable and increases the credit amount from $2,000 to $3,000 per child age 6 to 17 (and $3,600 per child below the age of 6). An estimated 3.56 million children across New York will benefit from this expanded tax credit, and it will lift 680,000 children in the state above or closer to the poverty line.

- Strengthens the EITC for childless workers, many of whom are in lower-paid but essential jobs on the frontlines of the COVID-19 pandemic response, benefitting 910,000 of these workers in New York.