The felony charges lodged Wednesday against Rep. Chris Collins, R-Clarence, sound complicated — securities fraud, wire fraud and conspiracy, among others.

But the underlying scheme at the center of federal prosecutors' case is actually quite simple: Collins tipped his son off to bad news coming from a biotechnology company, allowing his son and seven others to sell off their stock before its value tanked.

Here's a look at how the U.S. Attorney's Office in Manhattan and the Securities and Exchange Commission say all it went down:

Collins was a big shareholder

Chris Collins, 68, owned a big chunk of Australia-based company Innate Immunotherapeutics Limited — about 16.8 percent, according to federal prosecutors.

Collins was also a member of the company's board of directors.

His son, Cameron, 25, was also a big shareholder, owning about 2.3 percent of Innate's shares.

More: Rep. Chris Collins charged with securities fraud

In 2014, Innate began testing a drug the company had hoped would help treat a form of multiple sclerosis.

It had the potential to be a big moneymaker for the company since there aren't many treatments available for the disease.

But in June 2017, the company got bad news: The drug had failed its trial. It didn't show any promise in treating the disease.

It was a nightmare scenario for the company that was sure to cause its stock price to plummet.

Collins was tipped off

The company's CEO emailed Collins and other Innate directors on June 22, 2017, to say the drug had failed.

Collins was attending a congressional picnic at the White House when he got the email.

"Wow," Collins wrote back at 7:10 p.m., according to the indictment. "Makes no sense. How are these results even possible???"

As an Innate director, Collins was required to keep that information secret.

One minute later, Collins calls son

At 7:11 p.m. — one minute after he replied to Innate's CEO — Collins called his son, phone records in the indictment show.

His son didn't pick up, leading to several rounds of phone tag until the pair connected at 7:16 p.m.

Prosecutors say Chris Collins told his son in that phone call about the failed drug trial.

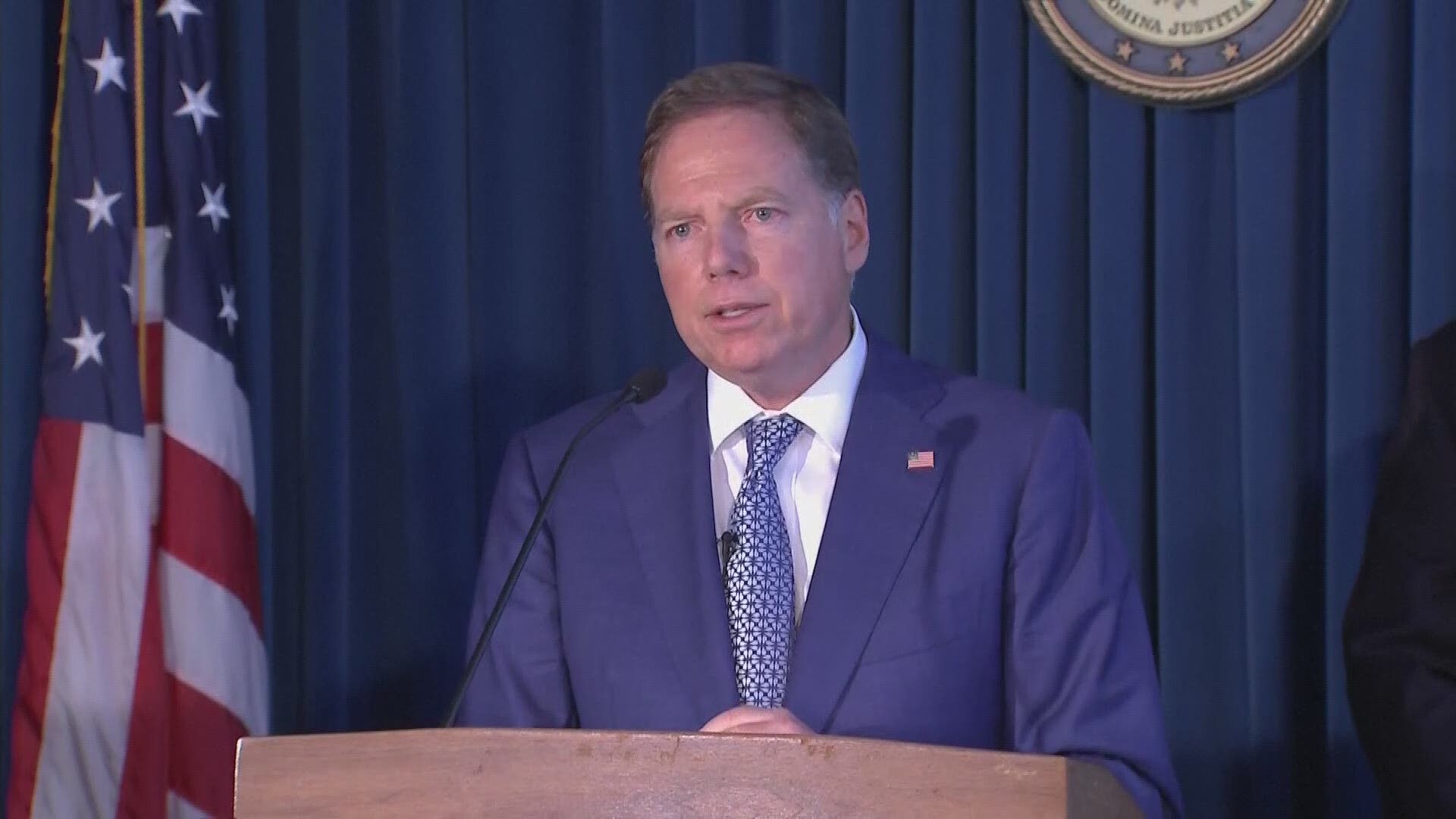

"He tipped his son to confidential corporate information at the expense of regular investors," U.S. Attorney Geoffrey Berman said.

Collins didn't sell off — but his son and allies did

Chris Collins couldn't sell off his stock, according to prosecutors; He was already under a congressional ethics investigation and his stock was in the Australian markets, which had already halted trading of Innate stock.

Read: The federal indictment against Rep. Chris Collins

Over the next few days, however, Cameron Collins sold off nearly 1.4 million shares of Innate stock.

Prosecutors have also accused Cameron Collins of tipping off his fiancee, his fiancee's parents and a friend. They sold off stock or tried to, too.

Innate stock tanks

After markets closed on June 26, Innate announced the news of the failed drug trial public.

The stock tanked — dropping from a value of about 46 cents per share on June 26 to about 4 cents per share the next day.

Collins' son, co-conspirators save $768K

Cameron Collins and seven others — including his fiancee's father, Stephen Zarsky, who was also charged in the case — avoided losses of about $768,000 by selling off their stock, according to prosecutors.

"This was the drop that was anticipated by the co-conspirators," Berman said. "They could only sell those shares on the initial tip of inside information by Congressman Collins."

Collins lied, prosecutors say

When the FBI interviewed Collins about the alleged scheme, prosecutors say he lied to cover his tracks.

The congressman spoke to the FBI on April 25, 2018.

"During this interview, Christopher Collins stated, in substance and in part, that he did not tell Cameron Collins, the defendant, the drug trial results before the public announcement," according to the indictment.

Cameron Collins and Stephen Zarsky, 66, are also accused of lying to the FBI.

The felony charges

For their role in the alleged scheme, Chris Collins, Cameron Collins and Zarsky are facing 11 felony charges each.

Each of the defendants are charged with seven counts of securities fraud and one count each of wire fraud, making false statements, conspiracy to commit securities fraud and conspiracy to commit wire fraud.

They're also facing a civil complaint from the SEC, which could carry financial penalties.

Collins maintains innocence

Chris Collins' attorneys Jonathan New and Jonathan Barr say their client is innocent, saying they will "mount a vigorous defense to clear his good name."

"We are confident he will be completely vindicated and exonerated," they said in a statement.