BUFFALO, N.Y. — There are more tax problems for some people who filed for unemployment benefits last year.

This all started when the federal government announced you wouldn't have to pay taxes on up to $10,200 worth of unemployment benefits, or twice that for married people, if your adjusted gross income is below $150,000 a year. That was after a lot of people had already filed their 2020 tax returns. So that meant many people paid too much and were owed money - a bigger refund from the IRS.

2 On Your Side has heard from a lot of viewers from Western New York asking when they will get the check from the IRS that includes the rest of their refund.

Well, according to E.G. Tax, the checks are slowly going out, but many of them are for the wrong amount. E.G. Tax says the IRS is overpaying people, sometimes by thousands of dollars, meaning eventually you will have to pay the overpayment back with interest.

"Have somebody double check the figures so you know if you got the right amount or not because you don't want a surprise, and we're thinking September, but the federal government is so far behind, it may be Christmastime when you get a nice bill in the mail. I don't think anybody wants that Christmas present," says Christopher Fabian with E.G. Tax.

Fabian says he expects it will be mid to late September before the IRS starts sending out bills to get the money back.

E.G. Tax is telling people not to spend the extra money.

"All we can do is be patient. It's really tough. Like I said, it's the worst year in over thirty years that I've seen for the IRS. We try probably two-hundred times a day to get in touch with them, and we're lucky if we get three calls put through. And we have a special practitioner number which is supposed to give us priority, and I wouldn't even bet on those odds if I was a gambling man for three out of two-hundred, so it's just terrible," said Fabian.

These problems are on top of the fact that some people are still waiting for their normal tax refunds, and they filed in March.

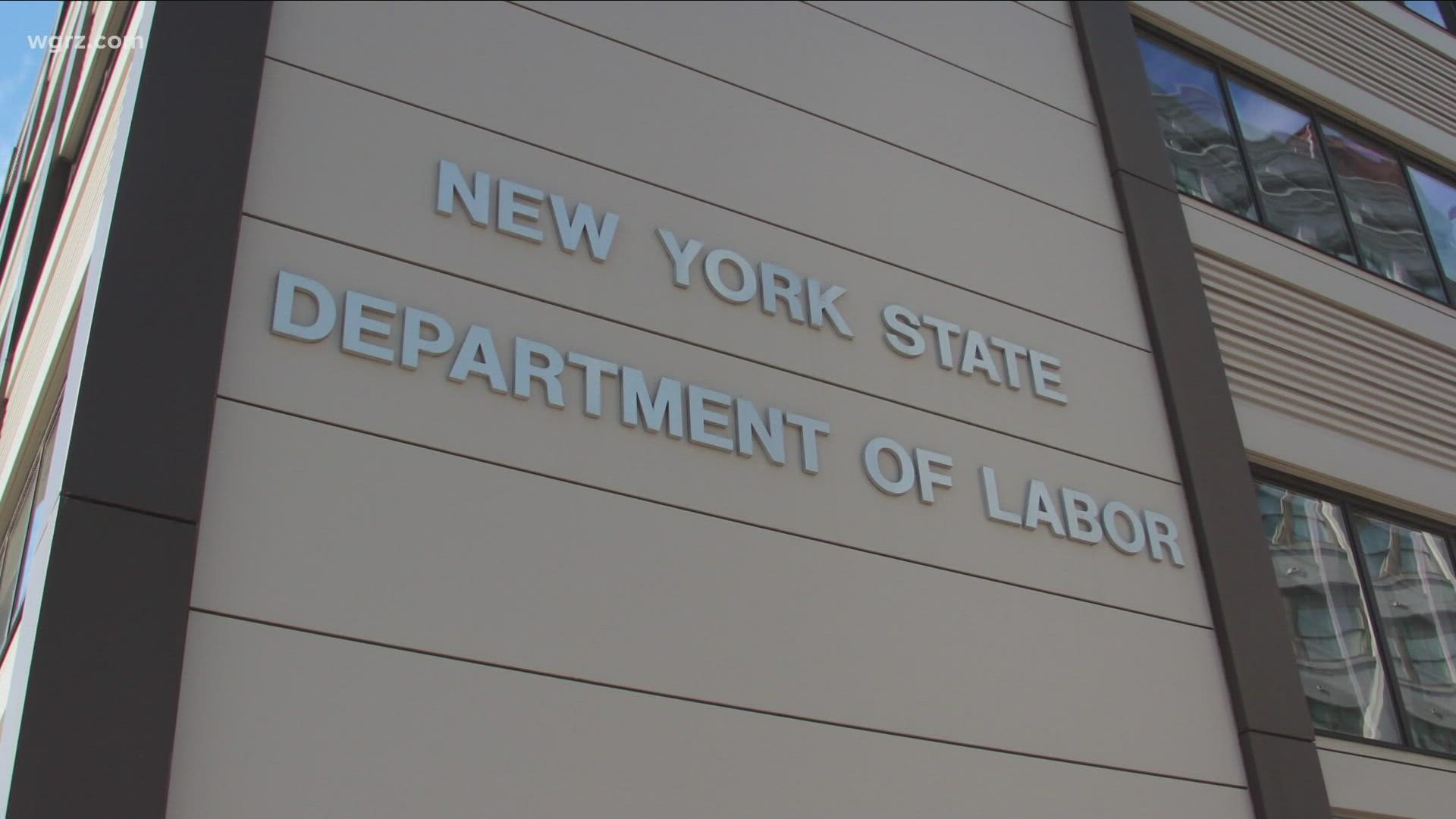

There is also new information for anyone who went back to work part-time and is filing for unemployment benefits.

These are changes for people in New York State who are working 30 hours or less a week. They just went into effect for the benefit week that started August 16. The new rules base your benefits on the number of hours you work each week, not the number of days you work.

To qualify, you have to make $504 or less in gross pay a week, excluding money you make from self-employment. You can work ten hours or less and not see a reduction in your weekly benefits, 11 to 16 hours and get 75-percent of your weekly benefit rate, and so on until it reaches zero if you work 31 hours or more and are considered full-time.

There is an online calculator to help you figure out how much your benefits will be.