The average household led by a retiree makes $48,000 annually before taxes and spends roughly $46,000 a year.

That’s according to the Bureau of Labor Statistics’ (BLS) measure of the income and outflow of “older households,” meaning ones headed by someone 65 or older. Meanwhile, the annual average pretax income for all U.S. households is about $74,000 and expenditures are $57,000.

While the main source of money for those still toiling in the 9-to-5 world is, of course, wages from work, who signs the average retiree’s $4,000-a-month paychecks?

Here’s the answer to the $48,000 question.

Retirees’ trillion-dollar allowance

By far the biggest source of income for retired Americans is Social Security, which in 2018 will pay out about $1 trillion in benefits, according to data from the Social Security Administration.

As of May, the average monthly Social Security benefit for retired workers was $1,412, or just shy of $17,000 a year. (Remember, this is per worker, not per household.)

Together Social Security and income from private and government pensions provide half — nearly $24,000 per year — of the income for the average older American household, according to BLS data. The second-largest chunk of retirement income — $3,300 a year, according to the data — comes from interest from savings, dividends from investments, and income from rentals and other property.

Getting by on multiple income streams

If you’re hoping an inheritance from a long-lost uncle will help you make it rain during your retirement, you should probably have a backup plan.

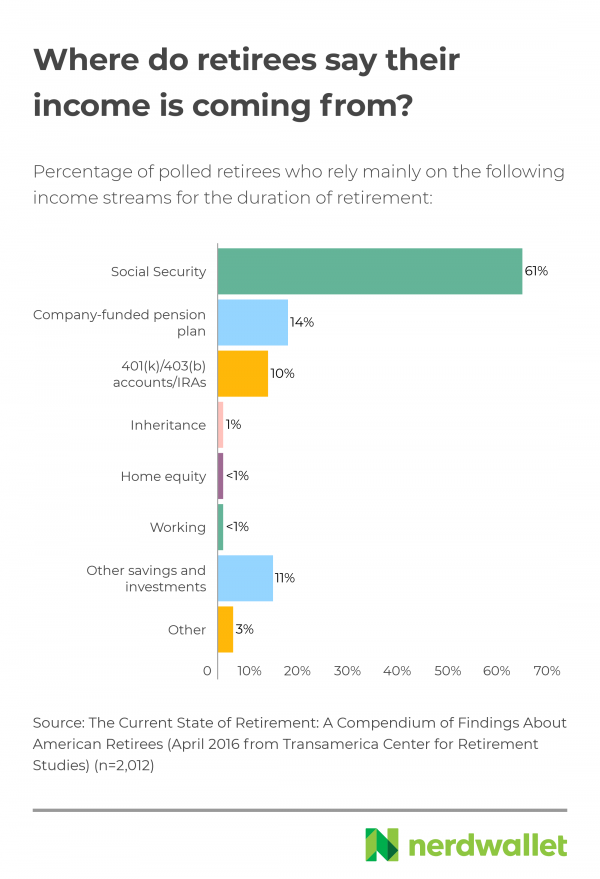

Just 1% of 2,012 retirees surveyed by the Transamerica Center for Retirement Studies and Harris Poll said an inheritance was a primary source of income for the duration of their retirement.

Although Social Security may pay out less for future generations, it’ll still be pumping out checks for some time. But if you’re not covered by a pension plan — and nearly half of the private industry workforce isn’t — 401(k)s and IRAs will be even more important in your suite of retirement income sources. (Here’s what you need to know about IRAs.)

Give yourself a retirement raise

If you’re worried about having enough money for food, shelter and mai tais in your golden years, there’s plenty you can do before, and even during, retirement to boost your income:

Supersize your Social Security check: It pays off to postpone filing for benefits until after you’re 67 (which is full retirement age for most people). If you can use other income sources for several extra years, your monthly benefit will go up by as much as 8% a year.

Give your savings a bonus when you turn 50: The IRS’ birthday present for those 50 and older is allowing them to contribute more money to tax-shielding accounts. In an employer-sponsored retirement plan like a 401(k) or 403(b), the maximum annual contribution limit increases from $18,500 to $24,500. In an IRA (Roth or traditional), you’re allowed to pad your account by an extra $1,000 on top of the $5,500 annual ceiling.

Get creative: Finding part-time work or taking in a renter are ways to augment a fixed income. On the flip side, downsizing your cost of living can make each dollar go further. Here are other ways to avoid the poorhouse in retirement.

How much retirement income will you have?

The answer depends on many factors — the age you retire, your life expectancy, monthly spending, long-term investment returns and more.

Don’t have all the answers yet? No problem. A retirement income calculator does the math for you, based on things like the stock market’s historical returns, average inflation rates and other inputs you can adjust based on your plans.

Type in your age, pretax income and current savings to find out how much retirement income you’ll have in your back pocket.

The article Could You Get By On the Average Retirement Income? originally appeared on NerdWallet.