TONAWANDA, N.Y. — Starting in 2023, tax brackets will change.

"Tax brackets are where you end up on the tax tables to define how much you're going to pay," said Christoper Fabian with EG Tax.

Fabian says the lower the tax bracket, the less you're going to pay in taxes.

With the rise of inflation, the federal government is now trying to give taxpayers a little help.

They're changing the brackets, so more people will fall into a lower tax bracket.

But it can be hard to understand, so here's an example.

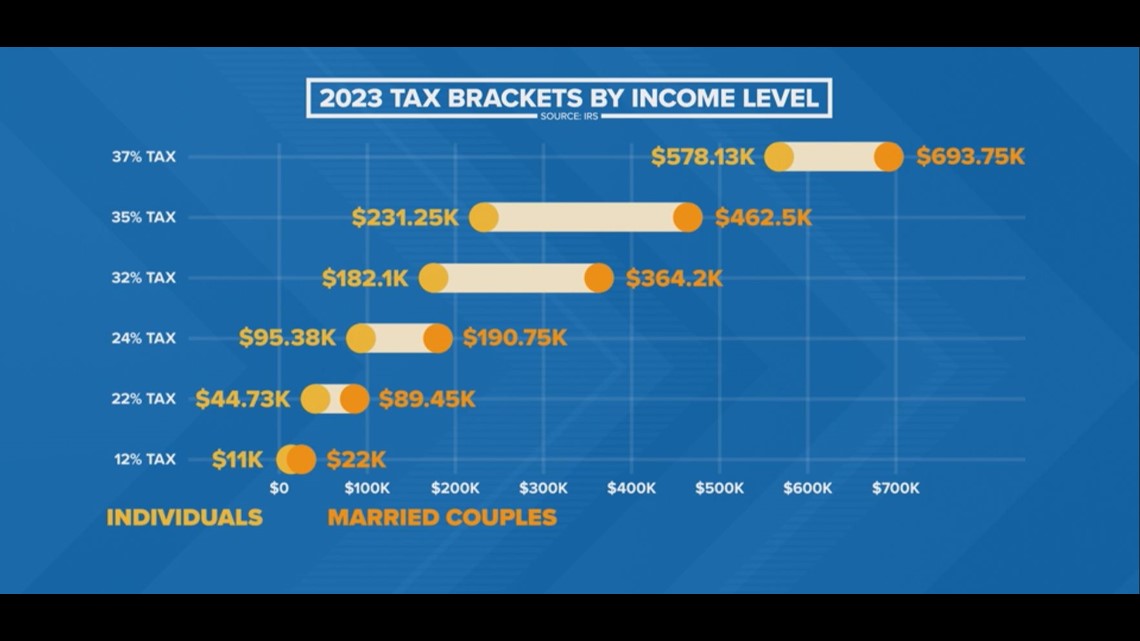

Let's say right now, you make $42,000 a year.

The first $11,000 you make is taxed at 10 percent.

Then $11,000 to $42,000 is taxed at 12 percent.

Any additional income over that $42,000 is then taxed at 22 percent.

Once the tax brackets change, you will only be taxed 22 percent on income between $44,000 to $95,000.

Here's a graph of how it'll impact other salaries as well, whether you're an filing taxes as an individual or filing as a married couple.

"For that person, it's saving a little bit of money, not a lot. But any savings is good savings. You've got to look at each individual individually and see how much it's going to pay. You can't just say an average person will make X-amount of dollars. There's too many variables into play," Fabian said.

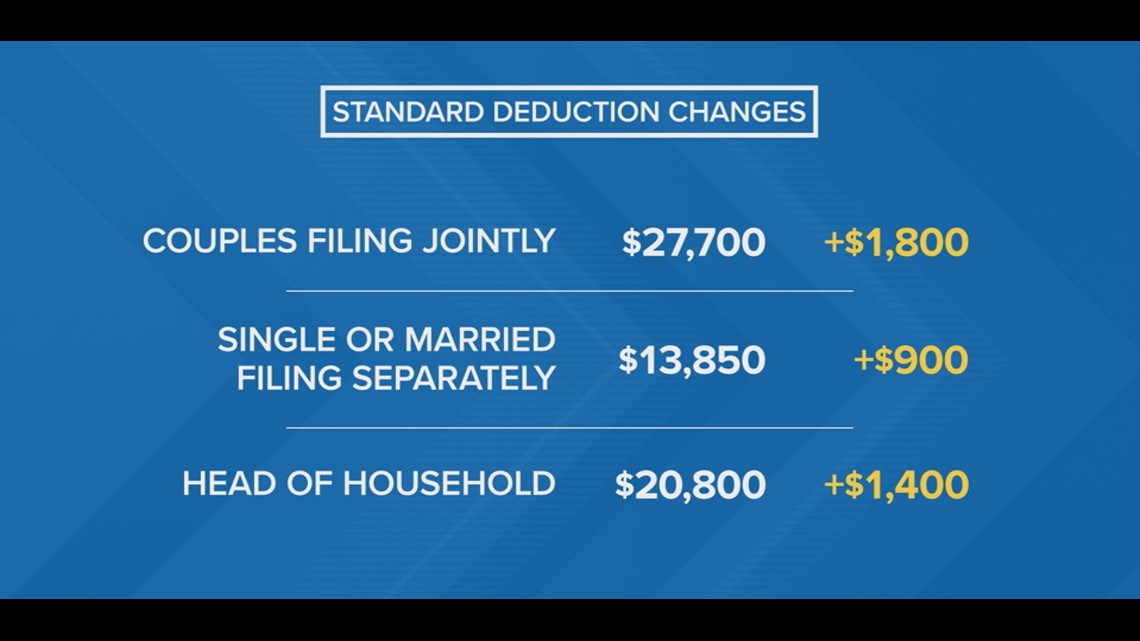

Standard deductions are also going up as well.

Here's what they are for couples filing jointly, individuals and married couples filing separately, and for the head of a household:

The number on the left in white is what it'll rise to in 2023, and the number in yellow is the difference from 2022.

While experts say this might only help save taxpayers a bit of money, it could really help others.

"Use it to your advantage. (For example), a senior citizen who is always worried about their minimum distributions from their IRAs and 401Ks. With this increase, they may be able to take more money out and not pay taxes," Fabian said.

If you have any questions about the changing brackets and standard deductions, talk to your tax preparer.