BUFFALO, N.Y. — While we bemoan our rising gas prices, some county and state lawmakers say it's also perhaps time to take a look at the taxes on those soaring per gallon costs.

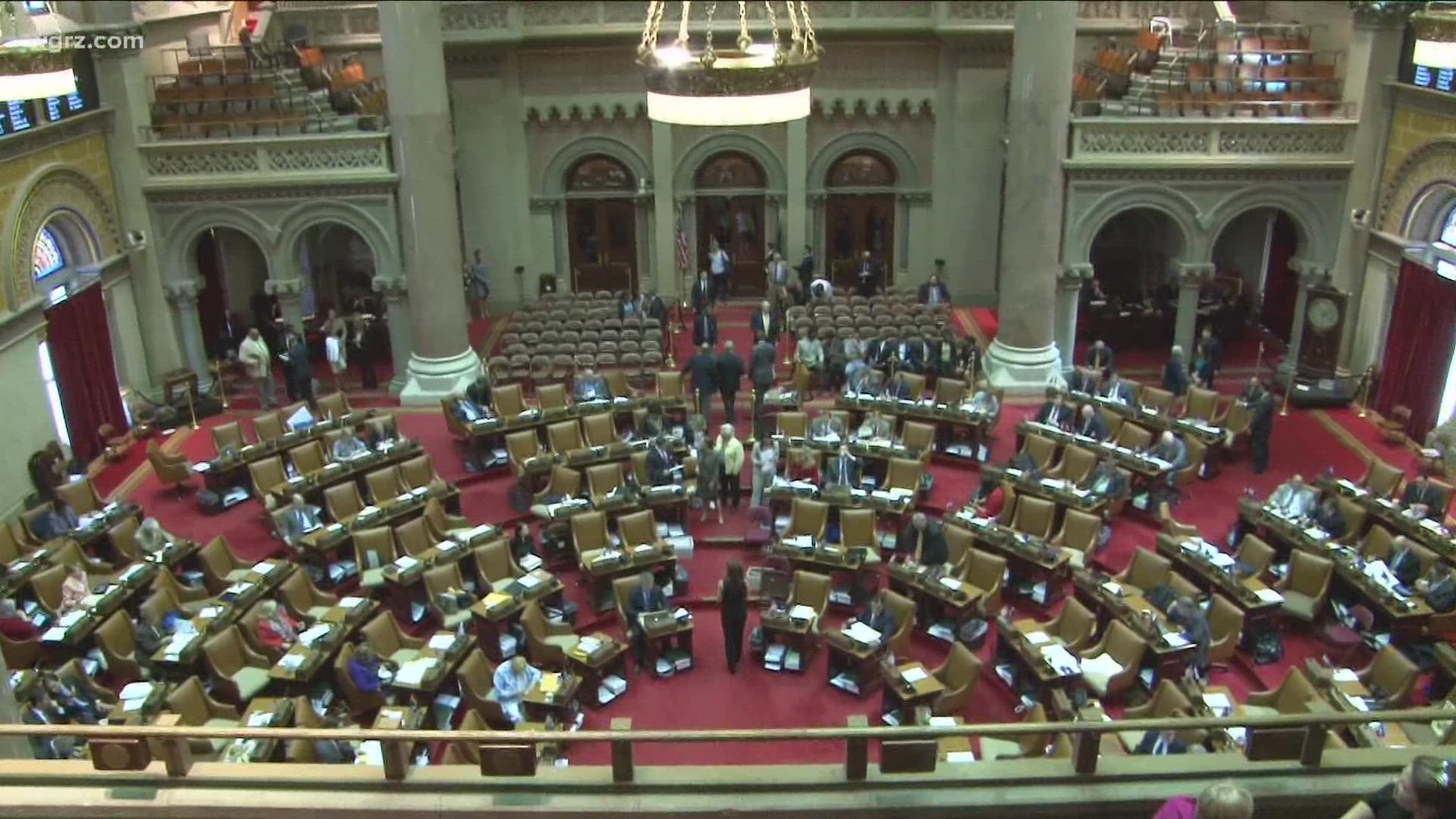

As our state lawmakers craft a new state budget with Governor Hochul in Albany, they're also hearing it from constituents increasingly frustrated with those increasing costs to fill up and run their vehicles.

One Democratic Assemblyman - Angelo Santa Barbara of Schenectady - recently added his voice to a chorus of GOP lawmakers by actually introducing a bill to suspend the collection of state sales taxes on gasoline while costs are so high.

Republican State Senator George Borrello of Jamestown says, "New York state should feel some of that pain also by losing that revenue. It might motivate our state to stop doing harm to our energy industry and start supporting New Yorkers and Americans in general."

That's because of all the taxes added to the basic per gallon price of gasoline by the state and federal governments before the sales tax is even applied. There are fees and taxes for petroleum business, spillage, and testing, and then excise taxes at the state and federal level which are supposed to go to highway construction and maintenance.

Borrello says, "The way to participate in the reduction of nearly 50 cents a gallon is to suspend that tax and it would at least provide immediate relief."

But after all those fees are applied it does get added overall with the 8.75% sales tax here in Erie County.

Erie County Legislator Joseph Lorigo is the minority leader.

"Based on the way the gas tax is calculated and that's a state law decision - it's not a county decision - but based on the way the sales tax is calculated on gasoline sales - it's being taxed at the highest level possible because we're paying tax on the cost of gas, the cost of federal taxes, and the cost of state taxes," Lorigo said.

So again the taxes and fees are taxed as well for actual double taxation.

"I think Erie County in the legislature we should be looking at ways to change that given the way, especially that we're sitting on unprecedented surpluses of money from the past two years," Lorigo said.

That would be pandemic relief funding from the federal government to cover COVID cost and recovery.

But on the other hand from Erie County Comptroller Kevin Hardwick.

"I think everybody would like to see taxes go down in general. But at the end of the day, there is a cost of government. And the question is what's the fairest way or the best way to pay for those services - do you wanna pay sales taxes or do you wanna pay property tax."

Hardwick's office points out the pandemic funding is limited and the county sales tax is also shared by school districts and local governments.

RELATED STORY: