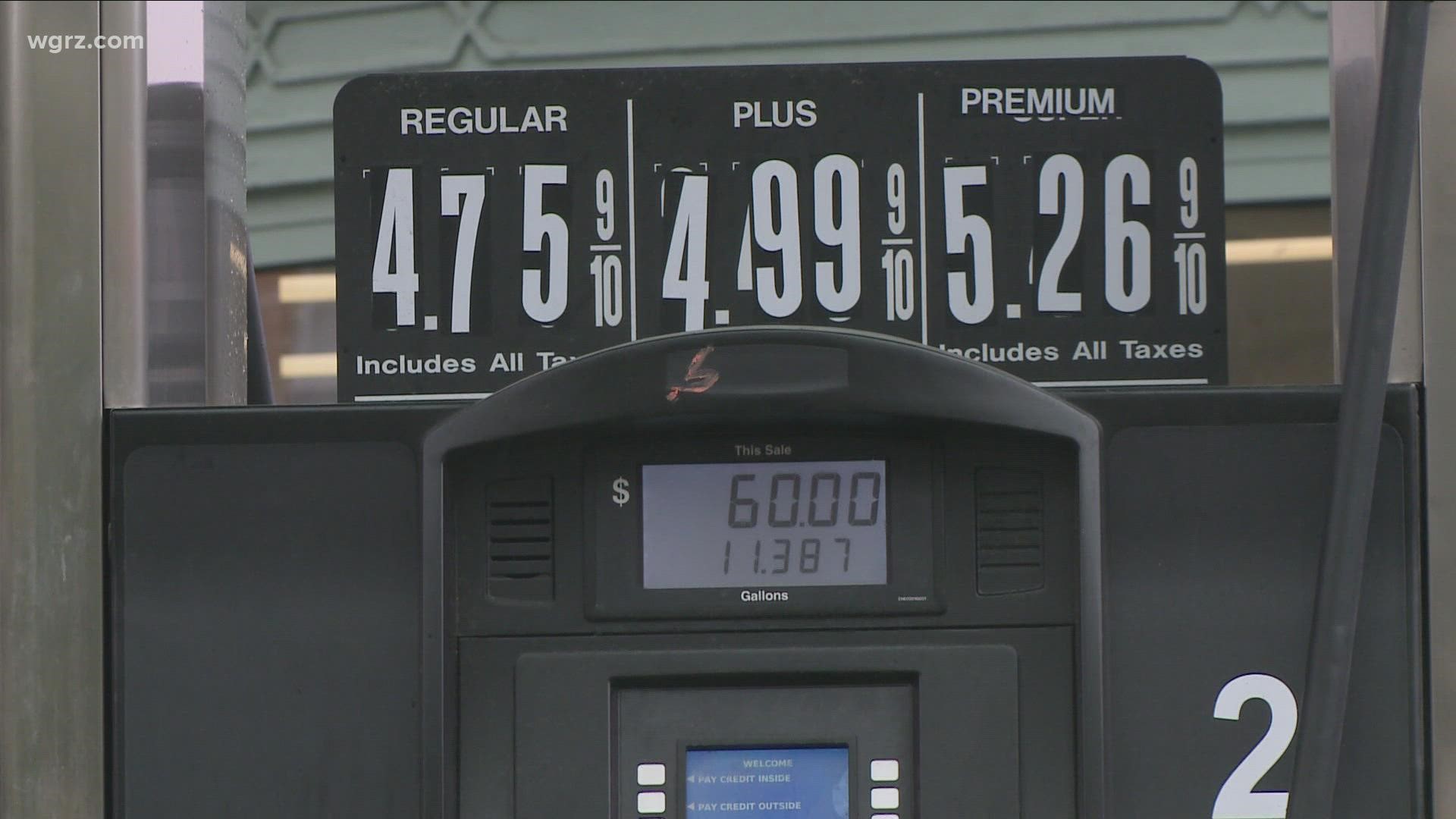

BUFFALO, N.Y. — As some pump prices are now at just about the $5 mark at some Western New York locations, some folks may ask why the gas tax relief at the state and county levels did not keep prices down.

Experts say global oil prices have kept climbing and past deliveries in tanks on the ground may not yet be factored in from the June 1 tax cap started. And back on April 8, we were told this by a gas station association leader in Albany.

"If it hits at a time when wholesale gasoline prices are rising rapidly and if retailers pass along that wholesale cost to consumers then it could reduce or blunt the savings."

That association leader declined an interview Tuesday saying they needed more information to see what is happening in the marketplace.

And it may not be easy to know what's going on according to Attorney Eugene Welch who is a former New York State Assistant Attorney General who served in the Rochester AG's office.

He says, "There was a lot of confusion earlier this week when...or last week when the taxes were removed from the price of gas. So everybody assumed that right away the prices at the pump were gonna drop. Well, apparently that didn't happen because what is in that gas tank in the ground that you're pumping into your car was already paid for at the increased tax rate. So those are all things that will have to be weighed by the Attorney General of the state of New York to determine whether or not somebody is gouging a consumer."

Erie County Executive Mark Poloncarz said he would have the county's Weights and Measure Department staffers checking prices to make sure tax relief was passed along. And New York State Attorney General Letitia James said her office would collect gas gouging complaints to possibly apply new regulations to offenders.

Neither responded to 2 On Your Side's request for an update Tuesday. But Welch says it may be difficult to apply the state's gouging law which was actually updated during the 2020 COVID supply crunch. It now refers to the charging of excessive prices for essential goods or services during "abnormal market disruptions".

So now there is an overriding question with a lot of gray areas in that law which in the past typically applied to pricing during natural disasters. Welch says there is no actual case law to as yet determine what a violation is.

"Is the price being raised unconscionably? And that is a gray term that would have to be decided by a court of law. And that's right in the price gouging statute. That determination is for a judge to make."

Some gas station owners are actually posting signs on their pumps informing customers to call their supplier if they have a complaint about the pricing.

"Everybody points up the chain to blame somebody else for why they charged the higher price. And that's why she (the State Attorney General) has subpoena power (for business records) to find out what the facts are," Welch says.

Determined violations of the state gouging law, if approved by a court, could bring $25,000 dollar fines. But Welch says it's not technically clear if the violation would apply to a single gallon of gasoline, or is it each customer who bought that gasoline, or is it applicable to a whole tank-load delivered to a gas station. So he says it could be $25,000 dollars times each gallon or each customer or collectively for the tank. Again he says that is not defined in the current law and may need case law to make a determination on a potential extremely high fine.

Welch also points out the attorney general could seek various legal remedies if a judge agrees there was an actual gouging law violation. He says she could seek an order for an immediate rollback of prices and she could force them to pay restitution to customers who were affected.

RELATED: