![tax_rebate[ID=16482493] ID=16482493](http://www.gannett-cdn.com/-mm-/f6a931e6ea44d7d1b3169d16bb8dec5bc387672c/c=0-0-341-292/local/-/media/WGRZ/None/2014/09/30/1412097421000-tax-rebate.png) ALBANY - The state has set up an appeals process for New Yorkers who believe they should have received a $350 family rebate check but didn't get one.

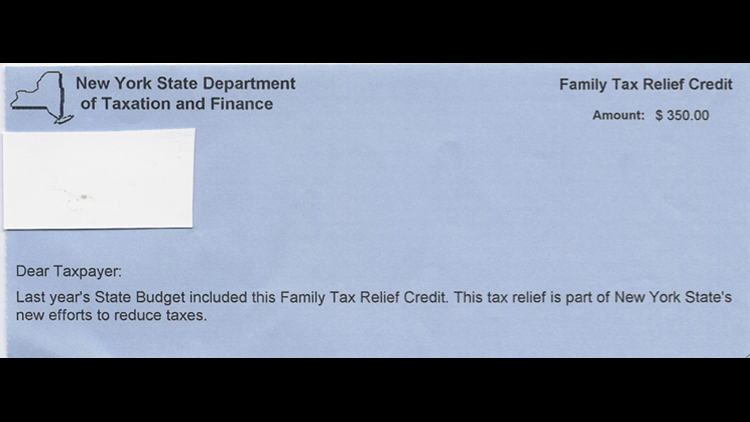

ALBANY - The state has set up an appeals process for New Yorkers who believe they should have received a $350 family rebate check but didn't get one.

In recent weeks, the Family Tax Relief Credit was delivered in a check by mail to people who had children under 17 when they filed their 2012 taxes and had a household adjusted gross income between $40,000 and $300,000. They also couldn't have any tax liabilities.

More than 1 million checks were mailed out based on the 2012 tax returns. People didn't need to apply for the money.

The state Department of Taxation and Finance set up an online application process for people who lived in New York in 2012 and might have been eligible for the check yet didn't receive one. There's also an online questionnaire to help determine eligibility.

"In the Fall of 2014, the Tax Department will automatically mail checks to eligible taxpayers," the taxation department says on its website. "If you are eligible for the credit, you do not have to apply. If you think you are eligible, but do not receive a check, you will be able to have your case reviewed."

Even people who moved out of the state after 2012 were eligible for the checks. Since the checks are based on 2012 tax returns, nearly 20,000 people who since have moved out of the state got the checks, state records showed, totaling nearly $7 million.

Suffolk, Queens and Nassau counties got the most $350 rebate checks, followed by Brooklyn, Westchester and Erie counties, state records showed. Checks went out to nearly 59,000 homes in Westchester, a total of nearly $21 million.

There were about 50,000 checks worth nearly $18 million sent to Erie County, while about 42,000 homes in Monroe County got checks totaling nearly $15 million.

About 20,000 checks went to people with a child in Dutchess County, a total of about $7 million. In Broome, 9,000 checks totaled $3 million, while Tompkins County received 4,500 checks totaling $1.6 million and Chemung County got 4,400 checks at $1.5 million.

Republican gubernatorial candidate Rob Astorino, the Westchester County executive, has called the money an election-year gimmick, while other critics have charged that people making up to $300,000 shouldn't get the checks.

Gov. Andrew Cuomo and the state Legislature approved the rebate checks in the state budget in 2013. It's one of two tax rebate checks headed to some New Yorkers this fall. Cuomo and the 213-member Legislature on up for re-election Nov. 4.

In the coming weeks, a tax-rebate check will go to homeowners for the increase in their school taxes this year -- if their school district stayed under the property-tax cap, which limits increases to less than 2 percent.

Both rebate programs will last three years. The $350 family rebate will be a credit on state income tax returns in 2015 and 2016.

"This much-needed relief for families is one of many steps taken by Governor Cuomo to control and reduce taxes and came as a result of four years of smart fiscal discipline," Cuomo spokesman Richard Azzopardi said last month. "As the governor has repeatedly said, New York has no future as the high tax capital of the world."

Should you get a $350 rebate check?

You are entitled to the $350 check if, on your 2012 return, you:

• were a New York resident for the entire year,

• claimed at least one child under age 17 as a dependent,

• had New York adjusted gross income (line 33 of your Form IT-201) between $40,000 and $300,000, and

• had a New York state liability after credits that is zero or greater.